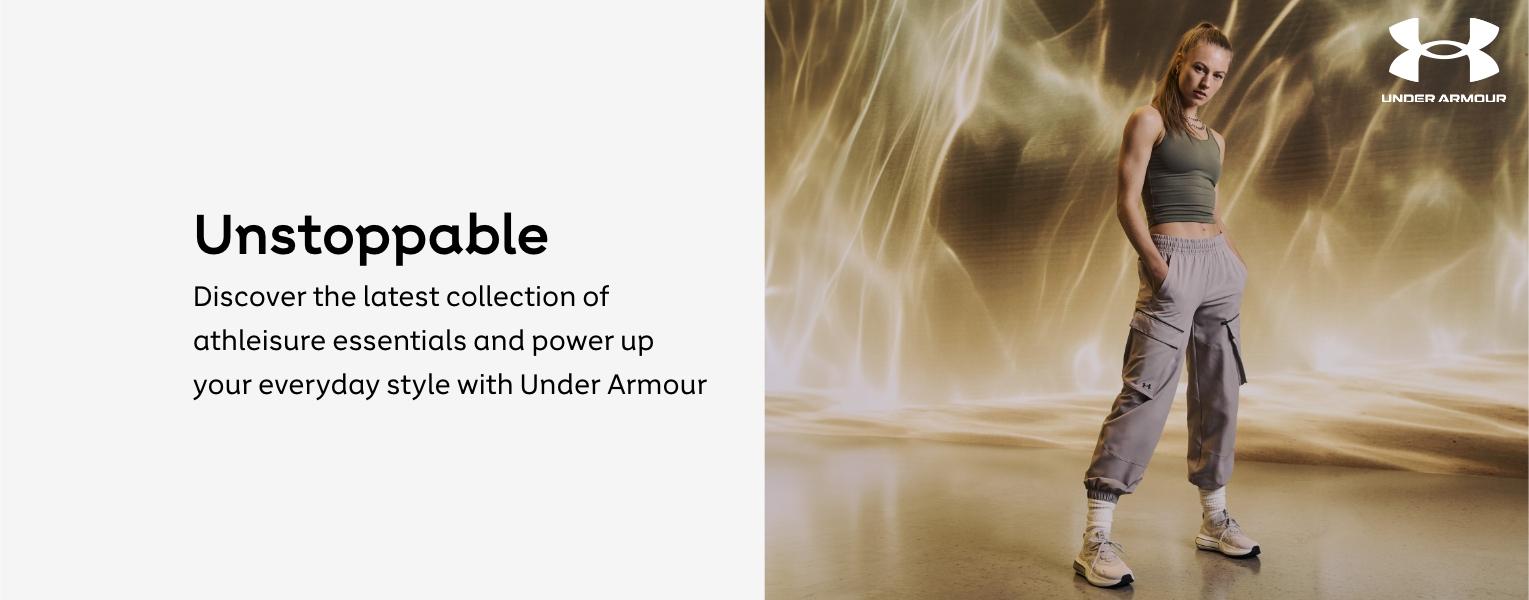

Sports clothing updated

With easy fits, dynamic details and fabric tech that make you feel as good as you look, this is the style solution that works and plays as hard as you do

Men's Clothing

Performance technology meets on-point styling for casual fits that are ready for anything

Shop nowWomen's Clothing

Wear-on-repeat essentials that combine premium quality comfort with cutting edge design

Shop nowKids' Clothing

Bring your mini-me on the Under Armour journey with feel good casuals with a distinctive sports flair

Shop nowTrainers

Great style starts from the ground up, and Under Armour trainers are one step ahead with lightweight construction and impact absorbing cushioning for life on the go

Men’s Footwear

Wherever life takes you, you’ve got the perfect foundation with Under Armour

Shop nowWomen’s Footwear

The perfect focal point for your casual wardrobe, where tech and trends combine

Shop nowKids’ Footwear

Keep their feet safe and supported in styles they’ll love to be seen in

Shop now

Sports Bras

From intense gym sessions to low-impact classes, find unbeatable support to suit every workout

Shop now

Bags & Accessories

Be prepared for any obstacle with bags and accessories that will help you bring your A-game

Shop nowInfinite support infinite moves

Built for your body, Under Armour Infinity bras are injected with figure-8 shaped padding for a lighter, more ergonomic fit. Offering support through your body’s natural movements, so you can train without limits.