Discover Samsung Crystal UHD TVs

Looking to take smart TV viewing to the next level? Samsung Crystal UHD TVs mean you can now watch your favourite films and shows in crystal clear colour, all in ultra-crisp 4K Ultra HD detail.

Lose yourself in crystal clear colour

Watch all the things you love come to life in over a billon shades of crystal clear, life like colour.

Shop now

Explore Crystal UHD TVs

Crystal clear viewing

Bingeing on a boxset or feasting on a blockbuster, you'll see everything in crystal clear, true-to-life colour. Watch every moment burst from the screen with striking 4K Ultra HD detail and stunning clarity.

When less, is stunningly more

Experience minimalistic style with a stunningly thin TV design that blends beautifully with your home. With a stunning clean back and no messy cables, it's been crafted to look perfect from any angle.

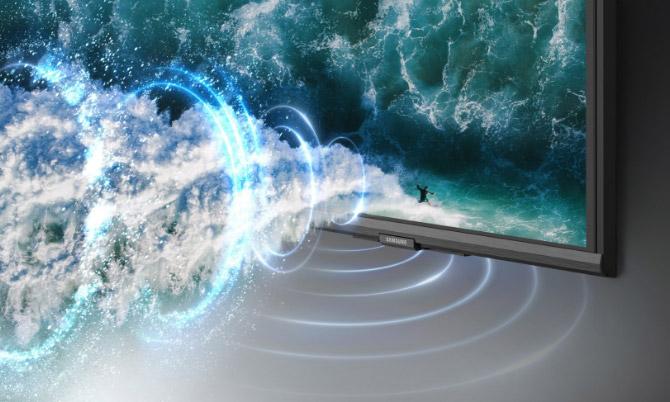

A complete audio experience

Object Tracking Sound LITE uses AI and your TV s bottom speakers to simulate overhead sounds. The result? Cinematic, 3D audio that follows the action - all without the need for extra speakers.

Clear picture for smooth gaming

Experience clear picture and smooth performance with Motion Xcelerator. Samsung's clear motion rate algorithms predict and automatically compensate frames, so your picture adapts as fast as your game.

Best-Selling Smart TV*

From Live TV to BBC iPlayer, Netflix, Apple TV, Disney+** and more, Smart TV Hub brings your favourite content and smart TV apps together in one place, whilst the all-in-one, universal One Remote Control links to your every device.

*Samsung TV has been ranked No.1 selling TV Brand for 16 consecutive years by Omdia. **Subscriptions required. Some apps may not be available at launch. 3rd party content providers may remove apps from the Smart TV platform or stop updating them at any time.